Can I File a Claim on a 20-Year-Old Roof? Homeowner’s Guide

Can I File a Claim on a 20-Year-Old Roof? Homeowner’s Guide to Insurance Coverage and Roof Replacement

Older roofs raise immediate questions for homeowners about insurance eligibility, payout amounts, and whether repair or replacement makes better financial sense. This guide explains how insurers treat damage to roofs around 20 years old, how policy types like actual cash value (ACV) and replacement cost value (RCV) affect settlements, and practical steps you can take to document and pursue a claim. You will learn which perils are typically covered versus excluded, why carriers often apply depreciation to older roofs, and how a professional inspection strengthens your position with an adjuster. The article also walks through a step-by-step claim preparation checklist, common denial reasons and appeal strategies, and clear criteria for choosing proactive replacement instead of filing a claim. Throughout the guide, semantic concepts like depreciation, covered peril, deductible, and inspection report are explained with examples so you can make informed decisions and, if needed, engage a contractor or claims advisor to support the process.

Will Homeowners Insurance Cover Damage on a 20-Year-Old Roof?

Coverage for a 20-year-old roof depends on the cause of the damage, the specific policy language, and how insurers apply depreciation for older materials. Insurers generally cover sudden, accidental perils—such as hail, wind, or fire—while excluding wear and tear or maintenance-related failures; age alone does not automatically void coverage but does influence scrutiny and payout calculations. Policy exclusions, endorsements, and deductible levels shape the final outcome, and many carriers require documentation or inspections for roofs approaching the typical lifespan of their material. Homeowners should review policy definitions of “covered peril” and “wear and tear” and prepare evidence of recent maintenance to reduce the chance that an insurer classifies damage as pre-existing.

What Types of Roof Damage Are Covered by Insurance Policies?

Insurance policies commonly distinguish sudden physical damage from gradual deterioration, and that distinction determines coverage. Covered perils usually include storm-related impacts like hail and wind uplift, fire damage, and damage from falling trees; these events are sudden and demonstrable and therefore more likely to trigger a claimable loss. Exclusions often cite wear and tear, long-term deterioration, faulty installation, and lack of maintenance—conditions insurers consider homeowner responsibility rather than insurable losses. To maximize clarity during a claim, homeowners should document the event, capture dated photos, and retain any maintenance records that demonstrate the roof’s prior condition and repairs, which helps separate sudden perils from pre-existing issues.

- The following table shows common damage categories and typical insurer responses.

This mapping clarifies that sudden perils are typically covered while long-term deterioration and installation defects fall under exclusions; documenting the event and maintenance history helps shift insurer evaluation toward coverage.

How Does Roof Age Affect Insurance Claim Eligibility?

Age affects both the insurer’s evaluation and the payout method rather than absolute eligibility; carriers may accept a claim for a 20-year-old roof but apply depreciation or require stronger proof of sudden damage. As roofs approach typical lifespans, insurers often request inspections, apply stricter proof standards, and may offer ACV settlements that factor in remaining useful life rather than full replacement cost. Homeowners with older roofs should expect adjuster scrutiny on repair history and may be asked to provide dated photos, contractor invoices, or evidence of routine maintenance to counter assumptions of neglect. Preparing this documentation in advance improves credibility with the insurer and reduces the chance that an adjuster classifies a loss as pre-existing wear and tear.

What Is the Difference Between Actual Cash Value and Replacement Cost Value for Roof Claims?

ACV and RCV define how insurers calculate payouts: ACV subtracts depreciation from the replacement cost, while RCV aims to cover the full cost to replace damaged property, subject to policy terms and documentation. ACV reflects the depreciated value based on age and expected lifespan, reducing homeowner recovery for older roofs; RCV can pay full replacement when the policy includes RCV coverage and the homeowner complies with requirements like providing repair receipts. Understanding the payout basis is critical for a 20-year-old roof because depreciation can dramatically lower ACV settlements, and obtaining RCV often requires proactive documentation and timely invoices to recover the balance after initial depreciation is withheld.

An Analysis of Actual Cash Value (ACV) Versus Replacement Cost in Insurance Claims

Although insurance claims have historically been assessed based on Actual Cash Value (ACV) and replacement cost, judicial bodies continue to deliberate on the specific valuations to be incorporated or excluded during claim calculations. Notably, the determination of what constitutes ACV or replacement cost for claim measurement is jurisdictionally dependent, varying significantly from state to state. Courts examine factors such as depreciation, including whether labor, overhead, and profit are subject to depreciation; the definition of “like kind and quality” in the context of replacement cost; the valuation of inventory, encompassing issues like obsolescence; the impact of external events such as widespread catastrophes; and the influence of these valuation methods on other policy provisions. ACV and Limitations in Depreciation Calculation: Upon property damage sustained by an insured, the policy’s valuation clause typically dictates the methodology for assessing the damage. The standard valuation under a policy is generally ACV. Policyholders often have the option to acquire replacement cost value coverage; however, the calculation of ACV remains relevant and essential, as replacement cost coverage typically only becomes applicable once the insured has actually undertaken the repair or replacement of the damaged property. Consequently, a common inquiry posed by insureds, their insurers, and insurance consultants is: What is the accurate method for measuring ACV? A layperson’s definition of ACV might be replacement cost minus depreciation. In fact MATH OR MYTH: CALCULATING ACTUAL CASH AND REPLACEMENT COST VALUES, 2018

The distinction between ACV and RCV is crucial for older roofs, as depreciation can significantly impact the final payout, making RCV a more desirable, though often harder to obtain, option.

This comparison shows why RCV is preferable when available and why ACV settlements are common for older roofs; proactive documentation and timely contractor invoices can convert withheld depreciation into final RCV payment.

How Do ACV and RCV Policies Affect Payouts on Older Roofs?

Under ACV, depreciation based on material lifespan reduces the payout for a 20-year-old roof, often leaving homeowners responsible for a substantial portion of replacement costs; RCV policies, by contrast, can reimburse full replacement if the homeowner provides proof of completed repairs and receipts. A numerical example clarifies the impact: if a full replacement costs $10,000 and the insurer applies 50% depreciation for age, an ACV payout might be $5,000 minus the deductible, whereas an RCV policy could ultimately cover the full $10,000 after the homeowner submits invoices. To increase the chance of RCV outcomes, homeowners should document pre-loss condition, obtain a professional damage estimate, and plan for timely replacement so depreciation holdbacks can be recovered.

Why Do Many Insurers Switch to ACV Coverage for 20-Year-Old Roofs?

Insurers shift older roofs to ACV to manage long-term exposure, limit payouts on predictable deterioration, and reduce moral hazard associated with replacing already aged materials at full cost. From the carrier perspective, roofs approaching or exceeding typical material lifespans have higher failure probability and lower remaining useful value, making ACV actuarially reasonable. Common insurer actions include non-renewal, offering ACV-only renewals, or requiring inspections before renewal; these steps are risk-management responses to rising material and replacement costs as well as claims frequency trends. Homeowners facing ACV offers should weigh short-term premium savings against long-term replacement expenses and consider options to improve insurability, such as partial upgrades or documented maintenance.

How Do I Prepare and File an Insurance Claim for a 20-Year-Old Roof?

Preparing a claim for an older roof focuses on demonstrating a covered, sudden event and supplying clear evidence to distinguish damage from wear and tear. Start by ensuring safety, document the scene thoroughly with dated photos and videos, and keep any weather reports or third-party documentation that corroborates a storm or event. Next, contact your insurer to report the loss, review policy limits and deductible, and request an adjuster visit while preserving damage evidence. Timely temporary repairs to prevent further damage are appropriate—document any temporary fixes with receipts and photos—and obtain a professional inspection and written estimate to help substantiate replacement need and cause of damage.

- Review your policy and note deductible, ACV/RCV terms, and covered perils.

- Take date-stamped photos and videos of damage from multiple angles immediately.

- Secure temporary tarps or repairs if there is an active leak, and save receipts for temporary work.

- Get a professional roof inspection and a written damage estimate from a licensed contractor.

- Submit a claim with the insurer promptly and include all photos, reports, and maintenance records.

These ordered steps help ensure you document the loss comprehensively and present a coherent claim package; the clarity and chronology of evidence make it easier for an adjuster to recognize a covered peril rather than attributing damage to long-term wear.

What Essential Steps Should Homeowners Take Before Filing a Roof Claim?

Before filing, homeowners should assemble a clear record that separates sudden damage from long-term deterioration by gathering maintenance logs, dated photos, repair invoices, and weather data. This pre-filing package should include recent inspection reports, any contractor estimates, and notes of when the event occurred to create a timeline linking cause to effect. Maintaining these documents reduces the likelihood an insurer deems damage pre-existing and improves the homeowner’s ability to argue for RCV when policy terms permit. Preparing this evidence also positions you to challenge partial denials or to appeal if the insurer initially treats the loss as wear and tear.

What Role Does a Professional Roof Inspection Play in the Claim Process?

A professional inspection produces an objective report with detailed photos, damage cause opinion, and a repair or replacement estimate that insurers respect when assessing claims. Inspectors identify impact patterns, loss extent, and whether damage aligns with sudden perils such as hail or wind versus age-related wear, which directly informs the adjuster’s determination of coverage. A well-documented contractor report can be pivotal during an adjuster visit, serving as a technical supplement to homeowner photos and helping convert withheld depreciation into RCV payments when repairs proceed. After an inspection, homeowners should submit the report to the insurer promptly and be prepared to walk an adjuster through specific findings during the on-site review.

After you collect evidence and secure a professional inspection, consider the next practical step: whether to accept an initial offer or prepare to appeal a denial or partial settlement using the documentation you gathered.

What Are Common Reasons for Denial of Roof Claims on Older Roofs and How Can I Appeal?

Claims for older roofs are often denied or limited because insurers determine damage resulted from wear and tear, lack of maintenance, pre-existing conditions, or issues excluded by the policy; misrepresentation of the roof’s age or prior damage can also trigger denials. Insurers routinely cite insufficient documentation of a triggering event, ambiguous cause of damage, or evidence of deferred maintenance as grounds for reducing or denying payouts. To appeal, homeowners must gather stronger evidence: independent inspection reports, dated maintenance records, contractor estimates, and any third-party corroboration (weather logs, neighbor reports). A structured appeal that addresses each denial reason with targeted evidence increases the chance of overturning the decision.

- Common denial reasons include:

- Wear and tear: Damage attributed to long-term deterioration rather than a sudden peril.

- Insufficient evidence: Lack of photos, timelines, or independent inspection to prove occurrence.

- Maintenance neglect: Records show deferred repairs or repeated leaks indicating neglect.

- Policy exclusions or prior damage: Claim intersects with excluded conditions or pre-existing issues.

These common denial reasons point to the core remedy: submit clear, dated evidence and objective third-party reports that document a sudden event and distinguish it from expected aging.

Why Are Claims on 20-Year-Old Roofs Often Denied or Limited?

Insurers worry older roofs have reduced remaining life and may display deterioration that mimics storm damage, so claims on 20-year-old roofs are scrutinized for signs of pre-existing wear, improper maintenance, or prior repairs. When an adjuster sees evidence of long-term granule loss, curling shingles, or patched areas, they may attribute active leaks to accrual of age-related defects rather than a recent covered event. Homeowners can counter this by presenting contemporaneous storm data, time-stamped images taken before and after the event, and contractor reports that identify impact patterns consistent with a covered peril. Demonstrating recent, documented maintenance further undermines insurer claims of neglect and improves the chances of a favorable outcome.

How Can Homeowners Appeal a Denied Roof Insurance Claim?

Appealing a denial requires methodical documentation and a clear, professional presentation that addresses the insurer’s stated reasons for denial and supplies counter-evidence. Begin by requesting the insurer’s denial letter in writing, review policy clauses cited by the carrier, and assemble new evidence such as an independent inspection report, detailed photographs, repair invoices, and any relevant communications. Next, prepare a concise appeal package that itemizes each denial point and responds with direct evidence; submit the appeal within policy timelines and follow up persistently. If the insurer remains unmoved, homeowners may escalate to a formal complaint with state insurance regulators or engage a public adjuster or legal counsel for representation.

- Appeals checklist:

- Obtain the insurer’s denial letter and note cited policy clauses.

- Gather additional evidence: independent inspection, photos, repair estimates.

- Prepare a point-by-point appeal document responding to each denial reason.

- Submit the appeal within the insurer’s stated timeframe and document all communications.

- Consider escalation to a regulator or hiring a public adjuster if necessary.

This appeals path transforms an initially incomplete claim into a structured, evidence-based request that directly confronts insurer concerns and improves prospects for reversal or supplemental payment.

When Should I Consider Roof Replacement Instead of Filing a Claim?

Replacing an aging roof proactively can be the smarter long-term choice when the roof is near the end of its expected life, when recurring small claims would raise premiums, or when ACV payouts would leave the homeowner with significant out-of-pocket expense. Proactive replacement reduces future risk of leaks and interior damage, can improve home value, and may restore eligibility for RCV coverage depending on insurer underwriting. Financially, if expected insurer payout under ACV plus deductible approaches or is less than the homeowner’s expected cost to repair recurring issues, replacement offers better value and peace of mind. Assess lifecycle costs, future premium impact, and the condition of roof components such as underlayment and flashing to decide whether replacement outweighs a one-time claim.

This comparison highlights when replacement is preferable: when ACV leaves large gaps, when recurring issues signal systemic failure, or when a new roof will reduce long-term costs and risks.

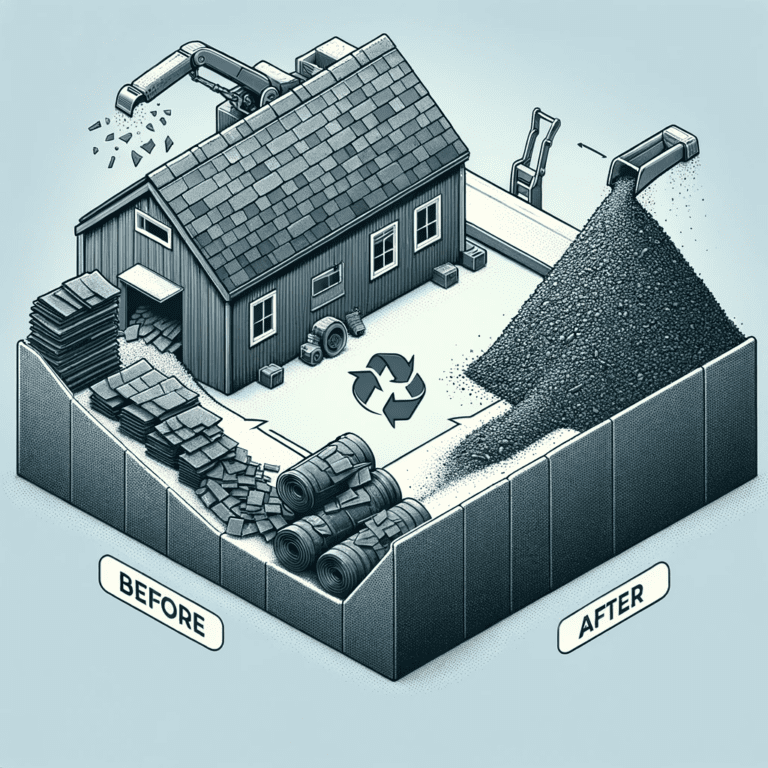

What Are the Benefits of Proactive Roof Replacement for Aging Roofs?

Proactive replacement enhances safety, restores full weatherproofing, and often comes with manufacturer or workmanship warranties that reduce future repair costs. A new roof can improve energy efficiency, curb appeal, and resale value, and may also allow homeowners to negotiate updated policy terms or qualify for RCV treatment at renewal. Financially, replacing proactively can prevent repeated minor claims that add up and potentially increase premiums or lead to non-renewal; it can also stabilize long-term maintenance expenses. Homeowners should compare replacement costs against likely ACV payouts and future repair estimates to determine ROI and timing.

How Does Roof Replacement Impact Home Insurance Policies and Premiums?

Replacing a roof typically prompts insurers to re-evaluate the home’s risk profile, which can lead to broader coverage options or changes in premium depending on materials and underwriting criteria. A new roof with modern materials may qualify a home for RCV treatment, reduced hail or wind surcharges, or lower age-based rating factors, though exact premium changes vary by carrier and region. Homeowners should notify their insurer after replacement, submit the contractor invoice and any certification, and request updated policy terms to capture improved insurability. Timely communication and documentation help ensure the insurer acknowledges the new condition and applies any available benefits during renewal.

How Can Alpha Roofing Help with Insurance Claims and Roof Replacement for 20-Year-Old Roofs?

Alpha Roofing provides targeted support designed to reduce homeowner uncertainty and improve claim outcomes through professional inspections, clear documentation, and end-to-end replacement services. The company’s core services include Roof Inspections, Roof Replacements, and Insurance Claim Guidance and Assistance, delivered with an emphasis on clarity about ACV vs RCV and depreciation so homeowners know what to expect during the claims process. Alpha Roofing prepares insurer-ready inspection reports with photos and cause-of-damage opinions, provides detailed replacement cost estimates, and helps homeowners organize evidence to maximize RCV chances when policy terms allow. By combining technical roofing expertise with practical claims guidance, Alpha Roofing aims to streamline decision-making and reduce the administrative burden on homeowners during stressful claim events.

What Comprehensive Roof Inspection Services Does Alpha Roofing Offer?

Alpha Roofing’s inspections focus on safety assessment, documented evidence, and cause-of-damage analysis to support both claims and replacement decisions. Deliverables include a written inspection report, high-resolution photos of damaged areas, notes on affected roof components (shingles, underlayment, flashing, decking), and a contractor opinion on whether damage aligns with a covered peril or is consistent with age-related deterioration. This report is structured to be insurer-friendly, enabling homeowners to present concise, technical evidence during adjuster meetings and appeals. The inspection also includes an approximate replacement cost estimate to help homeowners compare likely payouts under ACV versus the cost to replace.

How Does Alpha Roofing Assist Homeowners Through the Insurance Claim and Replacement Process?

Alpha Roofing supports the homeowner journey by documenting damage, providing estimates, accompanying homeowners during adjuster visits when requested, and scheduling replacement work once coverage and homeowner decisions are finalized. The company helps organize the claim packet—photos, inspection report, repair estimate—and explains how to submit receipts and invoices required to convert depreciation holdbacks into final RCV payments. For replacement projects Alpha Roofing manages timelines, material selection, permit coordination where applicable, and warranty explanations so homeowners understand coverage and expected performance. This hands-on assistance reduces administrative friction and positions homeowners to receive the best possible insurer outcome while moving efficiently toward a durable replacement.

- If you need inspection or claim support, Alpha Roofing’s inspection reports and claims guidance are designed to be used directly with your insurer to substantiate cause and cost; this professional documentation often strengthens negotiations and appeals.

- Inspection: Detailed report, photos, cause opinion, estimate.

- Claims support: Document assembly, adjuster coordination, follow-up.

- Replacement: Scheduling, workmanship warranty, post-install documentation.

These services are focused on clarifying ACV vs RCV implications for older roofs and providing actionable steps that homeowners can use immediately to improve claim outcomes or move forward with replacement.

Frequently Asked Questions

1. What should I do if my insurance claim for a 20-year-old roof is denied?

If your insurance claim for a 20-year-old roof is denied, the first step is to carefully review the denial letter to understand the reasons cited by the insurer. Common reasons include claims of wear and tear or insufficient evidence. Gather additional documentation, such as independent inspection reports, dated photos, and maintenance records, to support your case. You can then prepare a structured appeal that addresses each reason for denial with clear evidence. If necessary, consider escalating the issue to state insurance regulators or seeking assistance from a public adjuster.

2. How can I document my roof’s condition before filing a claim?

Documenting your roof’s condition before filing a claim is crucial for a successful outcome. Start by taking date-stamped photos of your roof from multiple angles, focusing on any existing damage or wear. Keep records of any maintenance performed, including dates and descriptions of work done. Additionally, gather weather reports that correlate with any damage events. This comprehensive documentation will help establish the roof’s condition prior to the incident and support your claim by demonstrating that the damage was sudden and not due to neglect.

3. What are the potential costs of roof replacement versus filing a claim?

The costs of roof replacement versus filing a claim can vary significantly. Filing a claim under an Actual Cash Value (ACV) policy may result in a depreciated payout, leaving homeowners with substantial out-of-pocket expenses. In contrast, proactive roof replacement, while requiring upfront costs, can prevent future claims and associated premium increases. Homeowners should evaluate the total costs of repairs, potential insurance payouts, and the long-term benefits of a new roof, such as improved energy efficiency and increased property value, to make an informed decision.

4. How does the age of my roof affect my insurance premiums?

The age of your roof can significantly impact your insurance premiums. Insurers often view older roofs as higher risk due to their increased likelihood of damage and failure. As a result, they may charge higher premiums or offer limited coverage options for homes with aging roofs. Additionally, if you file multiple claims on an older roof, this could lead to further premium increases or even non-renewal of your policy. Regular maintenance and timely replacement can help mitigate these risks and potentially lower your insurance costs.

5. What steps can I take to improve my chances of receiving a full replacement cost payout?

To improve your chances of receiving a full replacement cost payout, start by ensuring you have a Replacement Cost Value (RCV) policy rather than an Actual Cash Value (ACV) policy. Document the pre-loss condition of your roof with detailed photos and maintenance records. Obtain a professional inspection to provide an objective assessment of the damage and its cause. When filing your claim, submit all relevant documentation, including repair estimates and invoices, promptly. This proactive approach can help demonstrate the need for full replacement coverage to your insurer.

6. What role does a contractor play in the insurance claim process?

A contractor plays a vital role in the insurance claim process by providing expert assessments of the roof’s condition and the extent of damage. They can produce detailed inspection reports that include photographs, damage assessments, and repair estimates, which are crucial for substantiating your claim. Contractors can also assist in documenting the cause of damage, whether it aligns with covered perils or is due to wear and tear. Their expertise can strengthen your position with the insurer and help ensure that you receive a fair settlement.

7. How can I ensure my roof is eligible for insurance coverage in the future?

To ensure your roof remains eligible for insurance coverage in the future, prioritize regular maintenance and timely repairs. Keep detailed records of all maintenance activities, inspections, and repairs, as this documentation can demonstrate your commitment to maintaining the roof’s condition. Consider upgrading to modern roofing materials that may qualify for better coverage options. Additionally, communicate with your insurer about any changes or improvements made to your roof, as this can positively influence your coverage and premium rates during policy renewals.

Disclaimer: This article is for general educational purposes only and does not constitute legal, insurance, or financial advice. Insurance coverage varies by carrier and policy. Always review your policy documents and consult your insurance provider, claims adjuster, or an attorney for guidance regarding your specific situation.

Written by: Alpha Roofing’s Roofing & Insurance Education Team

Kevin is the owner of Alpha Roofing in Wilmington, NC, and has over 15 years of hands-on roofing experience specializing in shingle and metal roof replacements, FORTIFIED roofing systems, and insurance documentation support.

Before returning full-time to the roofing industry, Kevin was a Licensed Public Adjuster in North Carolina (license active until May 2017), giving him a unique understanding of how insurance carriers evaluate roof damage.

Today, Alpha Roofing focuses on roof inspections, documentation, and replacement services. We do not negotiate or interpret insurance policies. All coverage decisions are made by your insurance provider or licensed claims professionals.

Our role is to provide clear documentation so homeowners can communicate effectively with their adjuster.